Contents

Across North America, public discussion of lawyer compensation centers on highly publicized starting salaries at the largest law firms. These figures, while accurate for a narrow segment, obscure the income distribution for the majority of the legal profession. Solo practitioners and small firm lawyers represent a substantial share of the market, yet their earnings patterns differ significantly from those of attorneys in large institutional practices.

This analysis evaluates verifiable data on income for solo and small-firm lawyers in Canada and the United States. It examines median salaries, net income after expenses, and hourly rate benchmarks, supported by regional examples such as average income for small law firms in California, Florida, and British Columbia. This blog post will also analyze the structural drivers of income disparity, including practice area specialization, client concentration risk, adoption of legal technology, and diversification of billing models.

The shift toward independent practice is quantifiable. In recent years, over 30% of lawyers leaving mid-sized and large firms have opened solo or small practices, a trend evident in both major urban centers, such as Toronto and Vancouver, and secondary markets, like Austin and Atlanta. For this group, accurate financial benchmarks and proven operational strategies are essential to maintaining viability and improving profitability.

Here’s what you’ll learn:

- Average income for solo and small firm lawyers in North America, including median salaries, typical net income ranges, and comparison to national averages.

- Evidence-based strategies to increase income, including niche specialization, adoption of legal technology, implementation of alternative fee arrangements, and service diversification.

- Comparative earnings by firm size, with data on solo practices, mid-sized firms, firm owners, equity and non-equity partners, and “BigLaw” associates.

- Jurisdiction-specific income and hourly billing data for U.S. states to illustrate geographic effects on compensation.

- Operational and market positioning tactics that enable small practices to match or exceed the earnings of larger competitors.

Average Income for Solo and Small Firm Lawyers

A distinct two-tier market defines the earnings for solo and small firm attorneys in North America. This “bimodal distribution” creates a wide gap between the compensation at elite institutional firms and the entrepreneurial practices that serve the majority of clients, influencing both law firm profitability and public perception.

Positioning Small Firm Earnings in the Two-Tier Legal Market

The Cravath Scale drives the upper tier of the legal profession, a lockstep compensation model where starting salaries at major firms in markets like New York and San Francisco reached $225,000 in late 2024 and early 2025. Within these large firms, senior associates could expect base pay exceeding $435,000. However, these eye-popping figures represent a small fraction of the profession. In sharp contrast, the U.S. Bureau of Labor Statistics provides a more grounded perspective, reporting a median annual wage for all lawyers of $151,160 as of May 2025. This broader reality is home to most solo and small firm attorneys, whose earnings reflect a different business model. A successful solo attorney’s salary often falls between $100,000 and $250,000 net after expenses, though about 28% earn under the six-figure mark.

Geographic and Market Variability in Small Practice Revenue

Local market conditions heavily influence national averages. The NALP salary distribution for the Class of 2024 clearly illustrates this pattern: 53% of reported starting salaries fell between $55,000 and $100,000, a range standard in smaller firms and the government, while just 18.7% reported wages of $225,000, which are found almost exclusively in BigLaw. This plays out regionally, where small firm attorneys in California often earn over $170,000 due to higher billing rates, while their counterparts in Florida average closer to $130,000. Meanwhile, lawyers in markets like Halifax, Nova Scotia, or Austin, Texas, may generate less gross revenue but can maintain high law firm profitability by reducing overhead and dominating niche markets.

Ultimately, success for solo and small firms depends less on competing with BigLaw salaries and more on aligning revenue goals with local market rates, maintaining operational efficiency, and strategically positioning the practice to attract consistent, high-value clients.

Deconstructing Solo and Small Firm Attorney Earnings

Within the North American legal market, the solo and small firm segment is diverse, with earnings that span from financial precarity to high profitability. Relying solely on averages or medians obscures this reality. Averages are frequently skewed upward by a small cohort of high earners, while the median better reflects the income of the typical practitioner. Understanding the distribution of earnings is crucial for evaluating law firm profitability, assessing the revenue potential of small practices, and identifying the risks associated with various practice models.

Distribution of Attorney Earnings: A Skewed Landscape

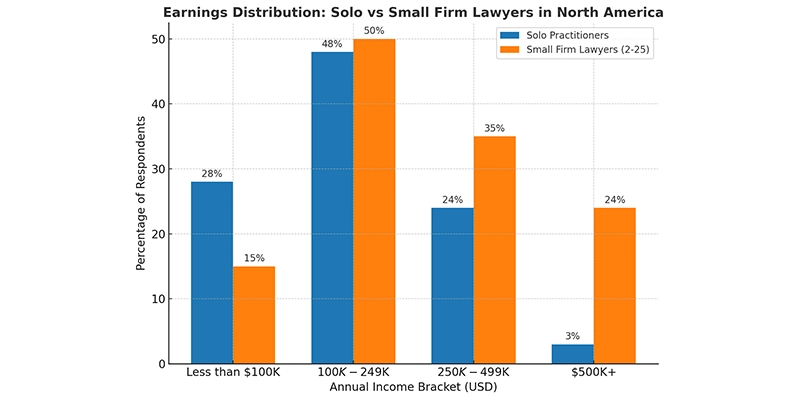

The 2024 Solo & Small Firm Compensation Survey by Above the Law and iManage found that 88 percent of respondents reported attorney earnings above 100,000 USD — a nine percent increase from 2023. The percentage of earners earning $250,000 USD or more has risen steadily over the past three years, indicating that the top end of the market remains robust.

However, other data reveal the underlying skew. A 2022 Martindale-Hubbell study found an average annual income of $198,000 USD for solo and small firm lawyers, but a median of only $148,000 USD — a nearly $50,000 USD gap caused by high-income outliers. In that survey, half of the respondents earned less than 148,000 USD.

Breaking the market into brackets illustrates the divergence:

- High earners: 24 percent of solo practices generate between 250,000 and 500,000 USD annually. Among firms with 11–25 attorneys, the proportion earning 500,000 USD or more doubled from 11 percent in 2023 to 24 percent in 2024.

- Lower earners: 28 percent of solo practitioners report incomes below 100,000 USD, underscoring significant financial risk for those without steady client pipelines.

This pattern confirms that the solo and small firm market offers both lucrative opportunities and substantial income volatility, making strategic positioning essential.

Solo Practitioners versus Small Firm Attorneys

Data consistently shows that solo attorney salary figures trail those of lawyers in small firms. The same Martindale-Hubbell report that produced the $198,000 combined average broke down the numbers: actual solo practitioners averaged $140,000, while attorneys in small firms averaged $226,000. Law360 Pulse findings align with solo practitioners (mean just under 190,000 USD, median 150,000 USD) earning more like associates than partners in firms of any size.

This difference reflects structural realities:

- Solo practitioners must originate clients, complete legal work, and handle business operations personally. Their income directly depends on their capacity to manage all three functions efficiently.

- Small firm lawyers may operate as associates with fixed salaries, as non-equity partners with salary-plus-bonus arrangements, or as equity partners who share in the total firm profits. Shared overhead, administrative support, and collaboration provide greater income stability and, for partners, higher upside potential.

These figures demonstrate why the term “solo and small firm lawyer” is analytically imprecise. The category includes lifestyle solos who deliberately limit their hours and income, struggling solos unable to generate sufficient billable work, niche specialists commanding premium rates, salaried associates in small firms with capped earnings, and equity partners in profitable boutiques whose income can rival that of BigLaw firms.

Strategic Implications for Career and Revenue Planning

For attorneys evaluating career options in the solo or small firm segment, the critical question is not “What do small firm lawyers make?” but “Given my practice area, location, and risk tolerance, what is the realistic income trajectory for a solo owner versus an associate or partner in a small firm?”

An attorney in a primary metropolitan market focusing on a high-value practice area with strong demand may achieve significantly higher law firm profitability than a counterpart in a rural jurisdiction practicing in a lower-yield field. Accurate self-assessment of market position, operational capacity, and client acquisition potential is crucial for determining realistic earnings expectations and selecting a business model that aligns with personal financial goals.

Operational Drivers of Law Firm Profitability

Market positioning determines the potential ceiling for attorney earnings, but internal operations decide how much of that potential a firm will realize. In the solo and small firm sector, profitability depends on controlling the entire revenue cycle, from generating billable work to collecting payments. Many firms generate sufficient revenue on paper but fail to convert it into cash flow due to inefficiencies in productivity, billing, and collections.

Key Performance Metrics that Shape Attorney Earnings

The financial performance of a solo or small law firm can be quantified through three primary Key Performance Indicators (KPIs): utilization, realization, and collection rates. Together, these metrics determine the proportion of available working hours that translate into billed and collected revenue.

- Utilization Rate measures the percentage of an attorney’s workday spent on billable tasks. Larger firms outperform solo practitioners by approximately 15 percentage points. In 2023, solos averaged about 31 percent utilization, small firms 36 percent, and larger firms 46 percent. Lower utilization among solos reflects the disproportionate amount of time spent on non-billable work, such as administration, marketing, and client intake.

- The realization rate is the percentage of billable hours that are invoiced. Solo and small firms average 86 percent, meaning 14 percent of completed work is never billed. This shortfall represents a direct and preventable revenue loss.

- The collection rate is the percentage of invoiced fees that are successfully collected. The solo and small firm average is 90 percent, resulting in 10 percent of billed revenue being uncollectible. Collection rates have improved by only four percentage points since 2016, indicating slow progress in accounts receivable management.

Leakage at each stage compounds into “lockup”—the total value of unbilled or uncollected work-in-progress. For small firms operating on thin margins, high lockup can restrict liquidity and threaten operational stability. Performance within the solo and small firm segment is uneven: the top quartile matches or exceeds larger firm benchmarks, while the bottom quartile shows severe inefficiencies across all three KPIs.

Alternative Fee Arrangements to Increase Revenue Retention

Shifting from the traditional billable hour to alternative fee arrangements (AFAs) can improve realization and collection rates by simplifying the billing process and aligning fees with client expectations.

- Flat Fees: Commonly used by 75 percent of solo practitioners and 65 percent of small firms, flat fees provide clients with price certainty. Solos often apply flat fees to an entire matter, such as an uncontested divorce, while small firms may use them for discrete phases of a case.

- Subscription Models: Popular with small business clients, these arrangements charge a fixed monthly fee for ongoing access to legal services. In Vancouver, British Columbia, firms offering startup-focused subscription plans have generated recurring revenue growth exceeding 40 percent in two years.

- Hybrid Models: Combine flat fees for predictable work with hourly rates for complex or unforeseen matters, striking a balance between transparency and profitability.

The adoption of AFAs is accelerating due to technology. As generative AI and automation reduce the time required for research, drafting, and standard transactions, the billable hour becomes less defensible for routine legal tasks. Some analyses estimate that firms relying exclusively on hourly billing could see up to 27,000 USD in annual revenue per lawyer at risk if they fail to adapt.

Controlling Costs and Increasing Technology ROI

Law firm profitability is determined as much by cost control as revenue generation. In solo and small firms, partner and staff salaries are the most significant expense, averaging more than one-third of total costs. Marketing, rent, and technology are the largest categories.

Technology spending remains disproportionately low among solo practitioners, who allocate around 1 percent of expenses to software compared to 2 percent for small firms and substantially more for larger firms. Hardware and software spending in large firms often exceeds $20,000 per year, while 74 percent of solo practitioners spend less than $3,000 annually.

This underinvestment is significant because the correlation between technology adoption and financial performance is direct:

- Firms using online payment systems collect payments more than twice as quickly as those that do not.

- The implementation of digital client intake tools, including e-signatures and online forms, can increase solo firm revenue by up to 53%.

While adoption rates for cloud-based practice management software are high, at 79 percent for solos and 81 percent for small firms, the data suggest that many firms fail to fully leverage these systems or expand into higher-tier tools, such as advanced analytics, workflow automation, and integrated marketing platforms. The primary barrier to improved profitability for underperforming firms is not a lack of client demand, but rather an inability to efficiently capture, bill, and collect the revenue generated by their work.

Income-Boosting Strategies for Solo Attorneys and Small Law Firms

Small law firms and solo attorneys in North America can materially increase law firm profitability by aligning practice structure, service delivery, and pricing models with the economic realities of their target jurisdictions. Earnings of attorneys in this sector vary significantly due to local market billing rates, client acquisition costs, and the selection of practice areas. Quantifiable results and jurisdiction-specific case studies support the following strategies.

Niche Practice Areas that Increase Small Practice Revenue

Specializing in high-demand legal sectors enables small firms to charge premium rates and reduce competition from general practitioners. Data from the Law Society of Ontario shows that intellectual property specialists in Toronto regularly bill 22 to 28 percent more than general corporate practitioners. Similar patterns appear in California, where boutique entertainment and media law firms in Los Angeles achieve hourly rates exceeding 500 USD for senior counsel. In Texas, oil and gas title specialists in Houston and Midland secure high retainers due to the limited supply of practitioners and the industry’s specific expertise requirements.

High-value niches in North America include:

- Intellectual property prosecution and enforcement in technology hubs such as Silicon Valley and Waterloo.

- Cross-border tax and trade compliance in cities with significant import-export activity, such as Vancouver and Buffalo.

- Complex medical malpractice litigation in jurisdictions with high claim volumes, including Florida and New York.

- Maritime and admiralty law in Atlantic Canada and the Gulf Coast.

Selecting a niche requires assessing local demand, the competitive landscape, and the jurisdiction’s average recoverable billing rates for that practice area.

Legal Technology Integration to Increase Billable Output

Technology adoption reduces administrative time and increases the number of billable matters a practitioner can manage annually. Cloud-based case management platforms can cut administrative time by 20 to 25 percent. E-discovery systems reduce evidence review time in litigation-heavy practices by as much as 40 percent. In Halifax, Nova Scotia, small litigation firms using automated document assembly report the capacity to close 15 to 20 percent more files per year without hiring additional associates.

Specific technology investments with the highest return on investment include:

- Document automation systems for transactional work and pleadings.

- Client portals with secure messaging and billing integration to reduce payment delays.

- Practice analytics dashboards to track realization and collection rates.

Alternative Fee Arrangements to Match Regional Client Needs

Rigid hourly billing structures can deter clients in competitive regional markets. Solo and small firm practitioners who implement alternative fee arrangements often achieve higher matter volume and improved collections.

- Flat fees are efficient for predictable workflows such as incorporations, wills, and uncontested divorces.

- Subscription-based legal service plans are effective for SMEs requiring ongoing advisory work.

- Hybrid structures combining capped fees for standard matters with hourly rates for complex work can protect profitability while meeting client expectations.

In Vancouver, British Columbia, a three-lawyer firm offering tiered subscription legal plans to startups increased recurring revenue by 42 percent within two years.

Targeted Networking and Referral Systems to Increase Attorney Earnings

A structured referral network can produce a steady pipeline of high-value matters. In Florida, small estate planning firms that established reciprocal referral agreements with certified financial planners increased file intake by 35 percent year over year. In Alberta, lawyers active in renewable energy trade associations secured representation contracts for multiple wind and solar developers, each valued at over $ 100,000 CAD annually.

Effective networking requires:

- Industry-specific involvement to establish credibility in target markets.

- Regular participation in professional associations that align with chosen practice areas.

- Maintaining a centralized database to track referral source performance and conversion rates.

Diversification of Legal Services for Revenue Stability

Small firms that add complementary services can offset fluctuations in core practice revenue. A Chicago litigation boutique that introduced mediation and arbitration services reduced trial dependency and grew annual revenue by 18 percent. In Atlantic Canada, maritime law practices that offer vessel registration consulting alongside dispute resolution have increased the average client engagement value by 25 percent.

Profitable diversification options include:

- Mediation and arbitration services to leverage litigation experience without trial scheduling risks.

- Continuing legal education instruction to monetize specialized expertise.

- Expert witness consulting for niche technical fields.

- Licensing and sale of proprietary legal templates and toolkits for recurring revenue.

RunSensible gives solo attorneys and small law firms the tools to increase revenue, improve collections, and capture more billable hours without adding staff. The same operational efficiencies and market positioning strategies discussed here become far easier to implement with a seamless integrated system, Book your free demo today!

Final Thoughts

The income profile for solo practitioners and small firm lawyers in North America is not a single predictable path but a complex structure shaped by market economics, strategic positioning, and operational discipline. The common focus on the fixed salary scales of BigLaw overlooks the reality that this segment operates in a far more variable and dynamic environment.

Our analysis shows a market defined by sharp contrasts. A significant proportion of solo practitioners earn less than 100,000 USD annually, while a growing group of entrepreneurial attorneys in small firms consistently generate incomes exceeding 500,000 USD. These outcomes are not the result of chance. They result from deliberate placement in profitable geographic markets, concentration in high-revenue practice areas, and managing the firm with the precision of a competitive business. High earners in this segment tend to optimize utilization, realization, and collection rates, invest in technology that expands billable capacity, and implement pricing models that reflect client needs and local market realities.

The challenges in this space are substantial. The income floor is often lower than in Big Law, business management demands are unrelenting, and market competition is intense. However, the rewards are equally compelling. Lawyers in solo and small firm settings retain control over practice design, can align their services with personal and professional priorities, and can achieve high levels of law firm profitability without the structural constraints of larger institutions.

The evidence supports a clear conclusion: in solo and small firm practice, attorney earnings are not simply the byproduct of legal skill, but the result of effective planning. Sustainable financial success is built through informed market choices, disciplined operations, and an entrepreneurial approach that embraces technology, targeted marketing, and service diversification. For those prepared to approach the business of law with strategic precision, the potential for both professional satisfaction and substantial income is significant.

Key Takeaways

- Earnings range widely: Solo attorney salary figures can fall below $100,000 or exceed $500,000, depending on market position, practice area, and operational efficiency.

- Geography matters: High-value metropolitan markets in California, New York, Ontario, and British Columbia offer significantly higher earning potential than rural or lower-demand regions.

- Practice area premiums, including personal injury, medical malpractice, intellectual property, and corporate law, continue to be the most profitable fields for small practices to achieve revenue growth.

- Operational discipline drives profitability: Firms that optimize utilization, realization, and collection rates outperform peers, often by double-digit margins.

- Technology adoption boosts revenue: Cloud-based practice management, online payments, and document automation can increase revenue by 15-50%.

- Diversification mitigates risk: Adding complementary services, such as mediation, consulting, or subscription-based legal plans, can help stabilize income in volatile markets.

FAQs

1. Why does income for small firm lawyers vary so much?

Income varies dramatically due to a “bimodal distribution” in the legal market. A small segment of lawyers at large “BigLaw” firms earn exceptionally high, set salaries (starting at $225,000 for new associates), which skews the public perception of earnings.

In contrast, the vast majority of lawyers, including solo and small firm practitioners, operate in a different market. Their income is not fixed and depends heavily on factors like:

- Firm Size: Solo practitioners average significantly less ($140,000) than lawyers in small firms ($226,000) because they bear the full weight of business operations alongside legal work.

- Geography: Local billing rates mean that a lawyer in a high-cost market, such as California ($170,000+), will likely earn more than one in Florida ($130,000).

- Practice Area: Specialized, high-demand fields yield higher revenue.

This creates a broad income spectrum, with some solos earning under $100,000 and successful small firm partners exceeding $500,000 annually.

2. Which practice areas are most profitable for a small law firm?

Focusing on a high-demand niche is one of the fastest ways to increase revenue, as it allows for premium rates and reduces competition. The article highlights several lucrative areas, including intellectual property, complex medical malpractice, cross-border tax, and maritime law.

Broader legal industry trends show high growth and spending in areas that are well-suited for small firms with specialized expertise, such as:

- Cybersecurity and Data Privacy: Driven by evolving regulations and increasing cyber threats.

- Labor and Employment: Fueled by new regulations, remote work shifts, and union activities.

- Health Law: Constant changes in healthcare technology and regulations create a steady demand for professionals.

- AI and Technology Law: Emerging legal questions around AI, data rights, and intellectual property are creating a new, high-value niche.

Choosing a niche requires matching your expertise with local market demand to ensure a steady stream of high-value clients.

3. Can Alternative Fee Arrangements (AFAs) make my firm more profitable?

Yes. Moving beyond the traditional billable hour can significantly boost profitability, client satisfaction, and payment speed. The article notes that relying exclusively on hourly billing puts up to $27,000 in annual revenue per lawyer at risk as technology makes routine tasks faster.

AFAs align your price with the value you provide, which clients appreciate. Standard profitable models include:

- Flat Fees: Used by 75% of solos, these offer clients price certainty for predictable work, such as uncontested divorces or incorporations. This transparency can prevent disputes over fees later.

- Subscription Models: Ideal for business clients, these generate predictable, recurring revenue by charging a fixed monthly fee for ongoing legal access.

- Hybrid Models: These models blend flat fees for standard work with hourly rates for unexpected complexities, striking a balance between client certainty and firm profitability.

By offering AFAs, firms can attract clients who might otherwise be deterred by the uncertainty of hourly billing, resulting in higher matter volumes and better collection rates.

4. How can I improve my firm’s bottom line without finding more clients?

Focus on operational discipline. Many firms lose significant revenue not from a lack of work, but from inefficiencies in how they track, bill, and collect for it. Improving three Key Performance Indicators (KPIs) can directly boost your net income:

- Utilization Rate: This is the percentage of your paid time spent on billable work. Since solos spend a significant amount of time on non-billable administration, utilizing technology to automate these tasks is crucial for increasing billable output.

- Realization Rate: This is the percentage of billable work that you put on an invoice. The average firm fails to bill 14% of its completed work—a direct and preventable revenue loss.

- Collection Rate: This is the percentage of invoiced fees you successfully collect. With the average firm losing 10% of billed revenue, improving collections through methods like online payments offers an immediate income boost.

Leakage at each stage creates “lockup”—the value of unbilled or uncollected work that harms your cash flow.

5. What technology gives the best return on investment (ROI) for a small law firm?

While 74% of solos spend less than $3,000 annually on technology, targeted investments provide a massive ROI by directly boosting revenue and efficiency. The highest-impact areas are:

- Practice Management Software: These cloud-based systems are the foundation. They integrate case management, billing, and client communication, with adoption rates around 80%. They are crucial for tracking the KPIs that drive profitability.

- Online Payment Systems: This is a simple but powerful tool. Firms that use online payments receive payment more than twice as quickly as those that don’t, resulting in a dramatic improvement in cash flow and collection rates.

- Client Intake and Portals: Digital intake tools, including e-signatures and online forms, can increase a solo firm’s revenue by up to 53%. Client portals with secure messaging also reduce administrative back-and-forth and payment delays.

- Document Automation: This technology can reduce administrative time by 20-25%, enabling practitioners to handle 15-20% more files per year without requiring additional staff.

The goal of technology is to reduce time spent on non-billable administrative tasks, freeing you up to focus on revenue-generating legal work.

6. Besides my practice area, what is the single most significant factor affecting my income?

Geography. Where you practice is a primary driver of your earning potential, as it dictates local market billing rates and client acquisition costs.

The difference is substantial: small firm attorneys in a high-cost market like California often earn over $170,000, while those in a lower-cost state like Florida average closer to $130,000. Major metropolitan centers such as Los Angeles, New York, Toronto, and Vancouver offer the highest potential hourly rates due to a concentration of high-value clients and industries.

However, high revenue doesn’t always mean high profit. Lawyers in smaller markets, such as Halifax or Austin, can achieve high profitability by dominating a local niche and maintaining lower overhead costs, demonstrating that strategic positioning within any market is key.

References

- 50 Surprising Solo Law Firm Statistics for 2025 – Embroker

https://www.embroker.com/blog/solo-law-firm-statistics/ - Solo & Small Firm Compensation | Above the Law 2024 Survey – iManage

https://imanage.com/resources/resource-center/blog/solo-small-firm-compensation-above-the-law-2024-survey/ - 2025 Legal Trends for Solo and Small Law Firms Report – IR Global

https://irglobal.com/article/2025-legal-trends-for-solo-and-small-law-firms-report/ - The 2024 Legal Trends Report – Clio

https://www.clio.com/resources/legal-trends/2024-report/ - NALP Research: Compare NALP’s Bimodal Salary Curve Over Several Years – NALP

https://www.nalp.org/salarydistrib - Lawyer Income Reports: How Much Can Solo Practitioners and Small Law Firm Attorneys Make? – Albatross Cloud

https://albatross.cloud/lawyer-income-reports-how-much-can-solo-practitioners-and-small-law-firm-attorneys-make

- Oregon State Bar 2022 Economic Survey – Report of Findings

https://www.osbar.org/_docs/resources/Econsurveys/22EconomicSurvey.pdf - The Complete 2025 Law Firm Salary Chart: A Strategic Guide for Mid-Sized Firms – LeanLaw

https://www.leanlaw.co/blog/law-firm-salary-chart-2025/ - Wages – American Bar Association

https://www.americanbar.org/news/profile-legal-profession/wages/ - Alternative Pricing Models – LegalFuel

https://www.legalfuel.com/alternative-pricing-models/

Disclaimer: The content provided on this blog is for informational purposes only and does not constitute legal, financial, or professional advice.