Law Firm Accounting Software

Reconcile to zero, stay compliant, and get paid faster

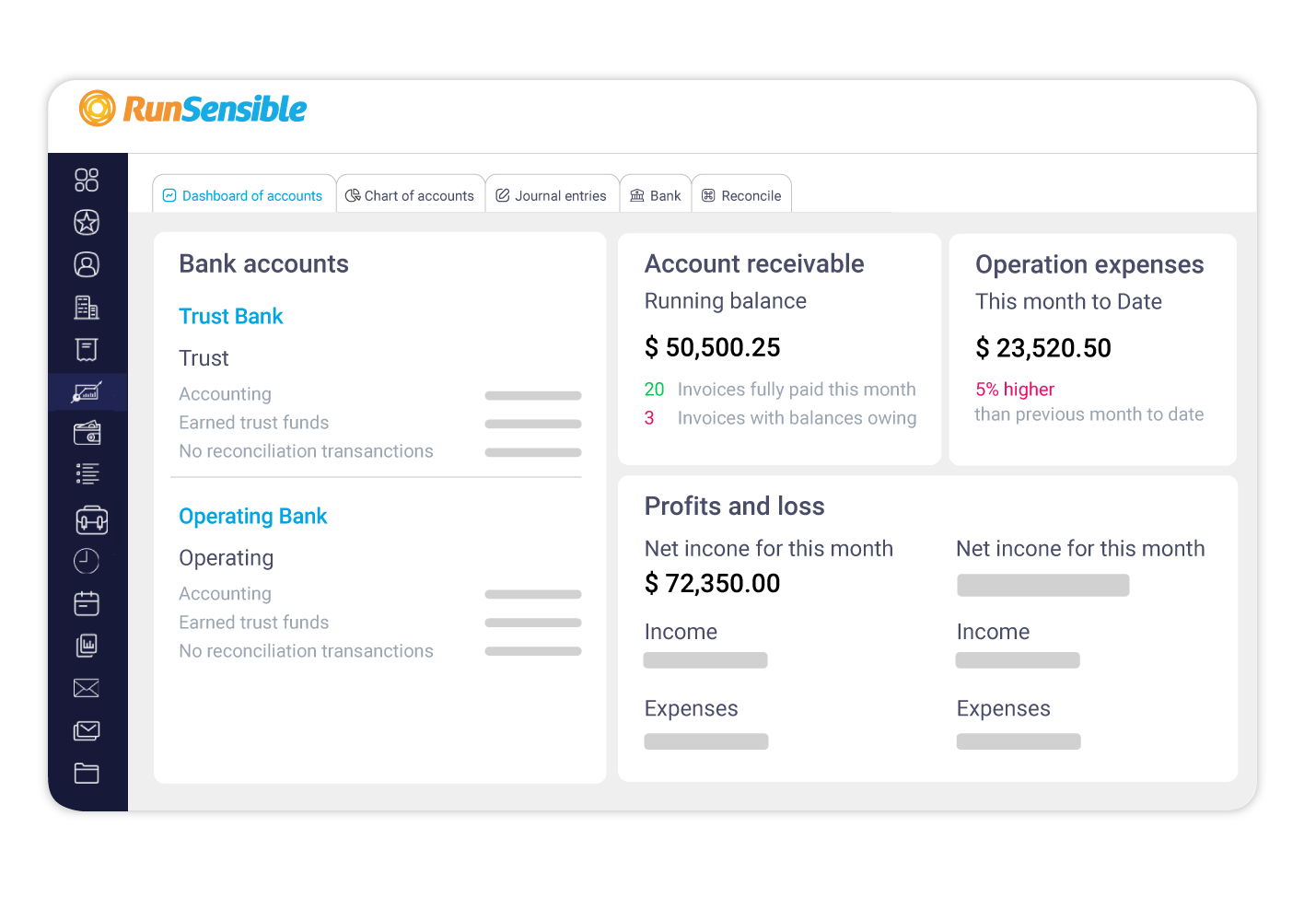

Stay on top of your finances and get the full picture, moving from matters to invoice to payment in a single, comprehensive platform.

- Trust and operating segregation

- Three‑way reconciliation support

- Client trust ledger and summary reports

- Audit trail, user roles, and approvals

Transform your legal billing and accounting for easy month-end accounting.

How RunSensible simplifies legal accounting

- Connect accounts. Link Operating and Trust accounts, or import statements.

- Track time and expenses. Capture as you work. Everything posts to the right matter.

- Invoice and collect. Send clear invoices with payment links. Automate reminders.

- Reconcile to zero. Use bank feeds and matching to close each month with a clean statement.

- Report with confidence. Send client trust reports to your law society with complete audit logs.

Optimize Client Funds Management with Trust Accounting Features

Designed for the legal industry, our system lets you handle your trust accounts as well as the firm’s operating accounts. From detailed transaction tracking to robust reporting, you can streamline your financial oversight and enhance trust with clients through transparent and accurate financial management. Elevate your law firm’s trust accounting practices and simplify month-end reconciliation.